These changes are largely driven by growing concerns about economic stability amidst global financial pressures. In particular, Japan’s unexpected policy shift and U.S. recession fears play a key role.

Moreover, Japan’s decision to raise its short-term policy rate disrupted the yen carry trade. This, in turn, caused a ripple effect in global markets, impacting Canadian bond yields.

Additionally, the U.S. Federal Reserve’s high interest rates have raised fears of an impending recession. Weak employment data and disappointing tech earnings have further amplified these concerns.

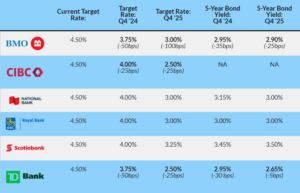

Consequently, Canadian bond yields have dropped to two-year lows, prompting further fixed mortgage rate cuts. This adds additional pressure on Canadian households with variable rate mortgages.

Furthermore, the Bank of Canada is increasingly focused on downside risks to the economy. Consumer spending and the labor market are now areas of particular concern.

With higher mortgage renewal rates expected in 2025 and 2026, household budgets could face significant strain. As a result, this might reduce discretionary spending and slow economic recovery.

Thus, the Bank of Canada must balance these risks while avoiding a resurgence of inflation. Therefore, a cautious approach to rate cuts is now more important than ever.

For consumers and investors, staying informed is crucial as the financial landscape continues to shift. Ultimately, strategic decisions must be made in response to these evolving conditions.

sited buy: https://www.canadianmortgagetrends.com/2024/08/the-big-banks-are-slashing-their-interest-rate-forecasts/