National Home Sales Sluggish

In July, national home sales dropped by 0.7% compared to June, according to the Canadian Real Estate Association (CREA). Although activity is still 4.8% higher than it was a year ago, sales remain about 9% below pre-pandemic levels.

Inventory on the Rise

Slower sales have resulted in an increase in available inventory, with 183,450 properties listed for sale at the end of July. This is a 22.7% increase compared to the same time last year, though it is still 10% below the historical average.

The ratio of sales to new listings eased slightly to 52.7% from 53.5% in June, which has put some downward pressure on average home prices in certain markets. The non-seasonally adjusted national average home price in July was $667,317, down 4% from June and remaining largely unchanged from last year.

Market Stability Across the Country

The MLS Home Price Index (HPI), which adjusts for seasonal variations, inched up by 0.2% month-over-month but is still 3.9% lower than a year ago.

BMO’s Robert Kavcic described the Canadian housing market as “stable” as it moves through the summer months. Sales volumes have held steady, the flow of listings is solid but not overwhelming, and prices remain stable across most markets.

Regionally, Alberta’s market remains relatively tight, though there has been some softening. Sellers’ markets continue to dominate in the Prairies and Atlantic Canada, driven by affordability and strong inward migration.

In contrast, Vancouver and Montreal markets are largely balanced and have shown strong price performance over the past year. Ontario, however, is showing signs of weakness, with several areas experiencing buyers’ markets.

Outlook for the Rest of the Year

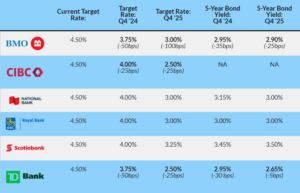

Although sales were subdued in July, there is optimism that activity will pick up in the latter half of the year as interest rates are expected to continue their downward trend.

TD’s Rishi Sondhi referred to July’s performance as a “speed bump” on the road to stronger sales and prices in the second half of the year, fueled by a resilient economy, robust population growth, and falling rates. He noted that August’s data would be crucial in assessing the impact of ongoing rate declines.

CREA chair James Mabey also suggested that the market is being set for a more active period ahead. He noted that many markets now offer more choices for buyers than in recent years, but warned that the window for a relaxed house-hunting experience might be closing.

BMO’s Kavcic pointed out that the ongoing subdued sales were anticipated, given that the recent Bank of Canada rate cuts have so far only benefited a small number of borrowers. He explained that since only 12.9% of new mortgage borrowers in the first quarter opted for variable-rate mortgages, the initial phase of rate cuts did not provide widespread relief.

Looking ahead, Kavcic suggested that if mortgage rates continue to decline, potentially reaching around 4% by next spring, the housing market could become more dynamic. For now, however, the market remains stable.